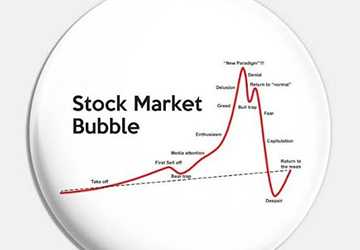

Investing in the stock market can be thrilling and profitable but also carries risks. One of the significant risks is investing during a stock market bubble. Understanding what a stock market bubble is, how to spot one, and how to avoid catching up can help protect your investments. Let's dive into the basics and then move into more detailed insights.

What Is a Stock Market Bubble?

A stock market bubble occurs when prices inflate rapidly to levels far exceeding their intrinsic value, driven by exuberant market behaviour. These inflated prices are unsustainable and typically followed by a sharp decline, or "burst," leading to significant losses for investors.

Historical Examples of Stock Market Bubbles

Learning from past bubbles can help investors recognize the warning signs. Here are a few notable examples:

The Dot-Com Bubble (Late 1990s - Early 2000s): The rapid rise of internet-based companies led to excessive speculation. Companies with little to no earnings saw their stock prices soar, only to collapse when reality set in.

The Housing Bubble (Mid-2000s): This bubble was characterized by skyrocketing housing prices fueled by easy access to mortgage credit and speculative investments in real estate. When the bubble burst, it led to a global financial crisis.

Bitcoin and Cryptocurrency Boom (2017): While not limited to stocks, the rapid rise in cryptocurrency prices, particularly Bitcoin, created a bubble. Prices skyrocketed and then plummeted, causing significant losses.

Critical Characteristics of Stock Market Bubbles

Recognizing the signs of a bubble can help you avoid getting caught up in the frenzy. Here are some key characteristics:

Rapid Price Increases: If stock prices rise unusually fast, it could indicate a bubble. Speculation rather than fundamentals often fuels this rapid increase.

High P/E Ratios: The price-to-earnings (P/E) ratio measures a company's current share price relative to its per-share earnings. Extremely high P/E ratios can indicate overvalued stocks.

Excessive Media Hype: When a particular sector or stock receives excessive media attention, it can increase prices as more investors jump on the bandwagon.

Speculative Investments: A significant increase in speculative investments, where investors buy stocks not based on fundamentals but on the expectation of selling them at a higher price, is a red flag.

Market Euphoria: When there's a widespread belief that prices will only go up, it can create an environment ripe for a bubble. This optimism can lead to irrational investment decisions.

How to Spot a Stock Market Bubble

To spot a potential stock market bubble, keep an eye on these indicators:

Unrealistic Valuations: When stock prices are far higher than historical norms or the company's earnings potential, it’s a warning sign.

Parabolic Price Movements: Stocks that shoot up illustratively, with little to no pullbacks, maybe in bubble territory.

Increased Leverage: If investors borrow more money to buy stocks, it indicates high confidence but can also amplify losses when the bubble bursts.

Market Sentiment: Pay attention to market sentiment. Extreme bullishness can signal that a bubble is forming. Tools like the Fear & Greed Index can be helpful.

Economic Indicators: Economic indicators such as GDP growth, unemployment, and interest rates can provide context. If stock prices are decoupling from economic fundamentals, it's a red flag.

Steps to Avoid Stock Market Bubbles

Avoiding stock market bubbles requires a disciplined approach to investing. Here are some strategies:

Diversify Your Portfolio: Diversification can help reduce risk. Spread your investments across different sectors and asset classes to avoid being overly exposed to a potential bubble in any one area.

Stick to Fundamentals: Focus on companies with strong fundamentals. Invest in businesses with solid earnings, good management, and a sustainable business model.

Set Clear Investment Goals: Define your investment goals and stick to them. Avoid getting swayed by market hype and speculative opportunities.

Regular Portfolio Review: Review your portfolio regularly to ensure it aligns with your investment goals and risk tolerance. Rebalance if necessary.

Stay Informed: Follow market trends and economic news. Being well-informed can help you make better investment decisions and spot potential bubbles.

Avoid the Herd Mentality: Don't unthinkingly follow the crowd. Just because everyone is investing in a particular stock or sector doesn't mean it's a good idea.

Long-Term Investment Strategies

Investing with a long-term perspective can help you weather market bubbles and downturns. Here are some long-term strategies:

Dollar-cost averaging involves Investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy can reduce the impact of market volatility.

Value Investing: Focus on finding undervalued stocks with solid fundamentals. Value investing can help you avoid overpaying for stocks during bubble periods.

Growth Investing: Invest in companies with solid growth potential, but be mindful of valuations. Avoid overpaying for growth stocks, especially during periods of market euphoria.

Dividend Investing: Investing in dividend-paying stocks can provide a steady income stream and reduce reliance on capital gains. Companies that pay consistent dividends are often more stable and less likely to be overvalued.

Psychological Aspects of Investing

Understanding the psychological aspects of investing can help you avoid making irrational decisions during bubble periods. Here are some psychological factors to consider:

Fear of Missing Out (FOMO): FOMO can drive investors to buy into a rising market, fearing they will miss out on gains. Recognize this feeling and make investment decisions based on logic, not emotion.

Overconfidence: During bull markets, investors might become overly confident, assuming prices will keep rising endlessly. Maintain a realistic perspective and be aware of the risks.

Herd Behavior: Herd behaviour can lead investors to follow the crowd, buying stocks simply because others are doing so. Make independent decisions based on thorough research.

Recency Bias: Recency bias causes investors to give more weight to recent events, assuming that current trends will continue. To make informed decisions, look at long-term data and historical trends.

Learning from Past Mistakes

Reviewing past mistakes can provide valuable lessons and help you avoid repeating them. Consider the following:

Analyze Your Investment History: Look at your past investments and identify patterns or mistakes. Understanding what went wrong can help you improve your strategy.

Seek Feedback: Discuss your investment decisions with trusted advisors or mentors. They can provide insights and help you see things from a different perspective.

Continuous Learning: Stay informed and educated about investing. Read books, attend seminars, and follow reputable financial news sources to keep your knowledge current.

Conclusion

Spotting and avoiding stock market bubbles is crucial for protecting your investments. By understanding the characteristics of bubbles, staying disciplined in your investment approach, and being aware of psychological biases, you can reduce your risk and make more informed decisions. Investing is a long-term journey; staying patient and informed is critical to achieving your financial goals.