Managing a stock portfolio can seem daunting, but you can make informed decisions and build a strong portfolio with the right strategies. The stock market's complexity and volatility can be overwhelming, especially for beginners. However, by following some fundamental principles and staying disciplined, you can navigate the market more confidently.

Here are ten practical tips to help you manage your stock portfolio effectively in 2024 and beyond. These tips guide you through the nuances of portfolio management, ensuring you make well-informed decisions to maximize your returns and minimize risks.

1. Diversify Your Investments

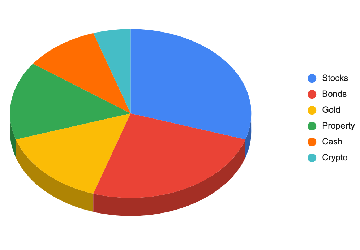

Diversification is a crucial strategy to reduce risk. Spread your investments across different sectors, industries, and geographical regions. This way, if one sector underperforms, the impact on your overall portfolio will be minimized. Avoid putting all your money into one stock or sector.

For example, if you invest in technology, healthcare, and consumer goods, a downturn in tech won't necessarily affect your entire portfolio. Diversification can include asset classes like stocks, bonds, and real estate.

2. Regularly Review Your Portfolio

Keep an eye on your investments and review your portfolio regularly. Market conditions change, and what was a good investment a year ago might not be performing as well now. Regular reviews help you stay informed about how your investments are doing and make necessary adjustments. Aim to review your portfolio at least quarterly.

During these reviews, check how your investments are performing, look at the balance of your asset allocation, and make sure your investments still match your financial goals.

3. Set Clear Financial Goals

Know why you are investing. Whether you're saving for retirement, a down payment on a house, or your child's education, having clear financial goals will guide your investment strategy. Your goals will also influence your risk tolerance and investment choices. For instance, if you're investing for retirement 30 years later, you might tolerate more risk than saving for a house in five years. Defining your timeline helps you select appropriate investments.

4. Understand Your Risk Tolerance

Risk tolerance is your ability and willingness to lose some or all of your original investment in exchange for greater potential returns. Assess your risk tolerance honestly and choose investments that match it. If you can't handle significant losses, opt for safer, more stable investments.

Use tools like risk tolerance questionnaires to get a better understanding. A high-risk tolerance might lead you to invest in growth stocks, while a lower risk tolerance might make bonds or dividend stocks more suitable.

5. Keep Costs Low

Be mindful of the fees associated with investing, such as management fees, trading commissions, and expense ratios. High fees can eat into your returns. Look for low-cost index funds or exchange-traded funds (ETFs) that offer broad market exposure at a lower cost. Over time, these savings can add up significantly.

For example, if an actively managed mutual fund charges a 1% fee while an index fund charges 0.1%, the cost difference can significantly impact your returns over decades.

6. Stay Informed

Stay updated on market news, economic indicators, and trends that could impact your investments. Use reliable sources and avoid making decisions based on hype or rumours. Being well-informed helps you make better investment choices. Subscribe to trustworthy financial news services, read the quarterly reports of companies you invest in, and monitor economic indicators like interest rates and employment figures. Staying informed is crucial for successful investing.

Additionally, consider joining investment forums or groups to discuss strategies and gain insights from other investors. Networking with fellow investors can provide new perspectives and valuable tips.

7. Rebalance Your Portfolio

Over time, some investments will perform better, causing your portfolio to drift from its original allocation. Rebalancing involves adjusting your portfolio to maintain your desired asset allocation. This can include selling high-performing assets and buying underperforming ones.

For instance, if your stocks have grown to represent 70% of your portfolio when your target was 60%, you might sell some stocks and buy bonds or other assets to restore balance. Rebalancing keeps your risk level steady and ensures your portfolio matches your financial objectives.

8. Avoid Emotional Investing

Getting caught up in market excitement or panic during downturns is easy. Emotional investing can lead to poor decisions like buying high and selling low. Stick to your investment plan and make decisions based on research and logic, not emotions.

Create rules for when to buy and sell investments, and stick to them. This discipline can help you avoid the common pitfalls of emotional investing, such as panic selling during market downturns. Remember that the market experiences fluctuations, and maintaining a long-term view can help you manage the instability.

9. Use Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money regularly, regardless of market conditions. This strategy can reduce the impact of market volatility and lower the average cost of your investments over time. It's a disciplined approach to investing.

By consistently investing, you buy more shares when prices are low and fewer shares when prices are high, which can lead to a lower overall average purchase price. This method can be particularly effective in volatile markets and helps remove the guesswork from investing.

10. Seek Professional Advice

Consider consulting a financial advisor if you need more clarification about your investment strategy or assistance managing your portfolio. A professional can provide personalized recommendations based on your financial situation and goals.

Look for fiduciary advisors, meaning they must act in your best interest. They can help you create a comprehensive financial plan, provide investment recommendations, and offer guidance on complex issues like tax and estate planning. A financial advisor can help you stay disciplined and focused on your long-term goals.

Conclusion

Effective stock portfolio management involves diversifying investments, setting clear goals, understanding risk tolerance, and minimizing costs. Regular reviews, rebalancing, and avoiding emotional decisions keep you on track. Dollar-cost averaging and professional advice can further enhance your strategy.

Investing is a long-term journey that requires patience and discipline to achieve financial goals. Stay committed, adapt as necessary, and make informed decisions. Patience, discipline, and informed decisions are your best allies in navigating the stock market successfully.